Situation on Financial Market in November 2022

- Operations of the National Bank in Monetary Policy

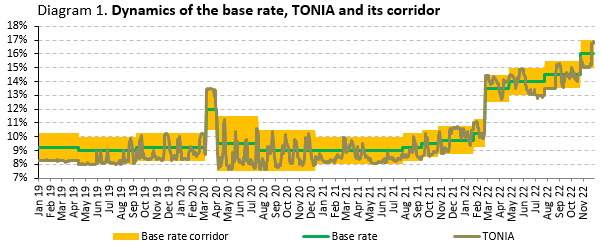

On December 5, 2022, the base rate was raised from 16% to 16.75% amid uncertain geopolitical conditions, persistently high food prices as well as domestic economic factors, including high inflationary expectations of the population, imbalance in supply and demand.

TONIA[1] indicator was formed within the interest rate corridor in November 2022 (diagram 1). In November 2022, following the base rate, the weighted average value of TONIA rose by 0.9 percentage points, and made 15.5% p.a. (14.6% in October). However, in November it was formed mainly near the lower boundary of the corridor, except for the end of the month in a tax week period.

Monetary policy instruments. At the end of November 2022, negative balance of operations of the National Bank (open position of the National Bank) on the money market totaled 3.2 trillion KZT.

Volume of short-term notes in circulation in late November 2022 was 1,593.3 billion KZT, (38.6% increase for the month). In November, 2 auctions of NBK notes were held for a total of 1,593.3 billion KZT with 1-month term notes (weighted average yield – 15.98%). The volume of repayment of short-term notes of the National Bank for November totaled 1,757.2 billion KZT.

Volume of liquidity withdrawn through deposit auctions plunged by 14.3% in November, and made 914.80 billion KZT (1,068.0 billion KZT at the end of October), bank deposits in the National Bank rose by 1.2% to 772.5 billion KZT (763.2 billion KZT in the end of October).

As of the end of November, about 49.6% of the withdrawn liquidity account for short-term notes, deposit auctions – 28.5%, and NBK deposits – 24%.

- Government Securities of the Ministry of Finance of the Republic of Kazakhstan

In November 2022, the Ministry of Finance of the Republic of Kazakhstan made 12 placements of government securities (MEOKAM – 2 placements, METIKAM[2] – 10 placements) in the amount of 287.8 billion KZT with maturity from 3 to 6 years. Yield on them ranged from 15.48% to 15.95% per annum.

Volume of securities of the Ministry of Finance of the Republic of Kazakhstan in circulation in November 2022 grew by 1.1% m/m and by 20.07% since the beginning of the year. [3]

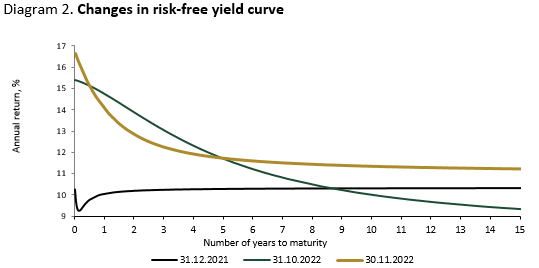

In November 2022, risk-free yield curve[4] demonstrates an inverted (reverse) shape. In particular, growth of the yield curve is reported in the short-term segment up to 1 year and from 5 years to 15 years, and in the segment from 1 year to 5 years there is a downward shift relative to October.

Source: KASE

- FX market

Against the background of balanced supply and demand for the USD in November 2022, the tenge exchange rate fluctuated within the range of 458.62 – 468.90 KZT per USD.

In November, increase in supply in the foreign exchange market was contributed by the quasi-public sector’s sales of foreign exchange earnings (USD 500 million) and minor foreign exchange conversions for transfers from the National Fund (USD 70 million). The National Bank had no currency interventions.

Total volume of transactions on the KZT-US dollar currency pair soared by 19.2% for the month (decrease by 17.7% y/y), including volume of exchange trading on the Kazakhstan Stock Exchange expanded by 20.6% m/m (decline by 21.1% y/y).

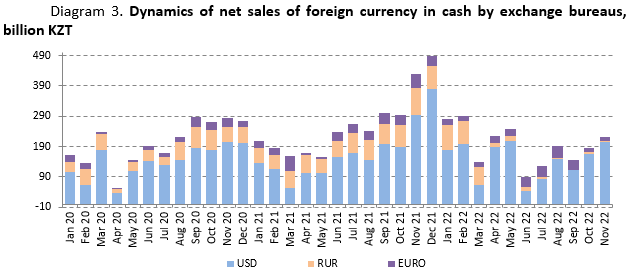

Demand for foreign currency from households increased. In November, net purchases of foreign currency climbed by 20.3% m/m up to 223.5 billion KZT. Along with that, in annual terms, total volume of net purchases plunged by 48.2%, mainly due to contracted net purchases of the USD and the Russian rubles.

The main volume of expenses was directed to the USD purchase – 91.6% or 204.6 billion KZT, to the RUR purchase – 1.3% or 3.0 billion KZT and to Euro purchase – 7.0% or 15.6 billion KZT. In November, demand for the Russian rubles slightly exceeded supply, while net purchase of the Russian rubles declined by 2.3 times for the month (30.1 times y/y).

In a breakdown by type of currency, net USD purchase increased by 24.2% for the month (a 30.8% decrease y/y), net euro purchase rose by 14.6% (a 3.0 times decrease y/y).

- International Reserves and Monetary Aggregates

Gross international reserves of the National Bank in November 2022, according to preliminary data, grew by 2.9% and totaled USD 33.9 billion.

The reserves widened due to a 7.4% increase in gold prices to USD 1,760 per ounce. The impact of gold price growth was partially offset by an outflow of funds from second-tier banks (hereinafter referred to as the ‘STBs’) foreign currency accounts with the National Bank.

International reserves of the country as a whole, including assets of the National Fund in foreign currency (USD 55.8 billion), at the end of November totaled USD 89.75 billion.

The monetary base in November shrank by 5.3% to 11,719.9 billion KZT (a 7.0% expansion since the beginning of the year) against the background of a decrease in transferable bank deposits.

In November, money supply contracted by 1.6% and totaled 32,768.4 billion KZT (increase by 8.9% since the beginning of the year and 14.2% y/y), cash in circulation reduced by 1.8% (increase by 8.5% since the beginning of the year, and increase by 11.9% y/y). Individuals’ lending in annual terms, first of all consumer and mortgage lending, continues to be the key factor behind the growing money supply.

- Deposit Market

Volume of the residents’ deposits in the deposit organizations decreased by 1.6% m/m to 29.5 trillion KZT (a 14.4% increase y/y). Corporate deposits decreased for the month by 5.9%, retail deposits rose by 3.1%. The decrease in volume of the deposit portfolio was attributed to a 4.8% contraction of the foreign currency deposits, while KZT deposits slightly increased by 0.1%.

Volume of deposits in the national currency increased in November due to the 3.0% increase in retail deposits. Foreign currency deposits decreased due to a 10.5% reduction of corporate funds.

Against this background, the level of deposit dollarization in November reduced to 34.2% (35.3% in October, 36.0% in December 2021).

In the dollarization structure, the gap between dollarization of legal entities and individuals has decreased. Thus, in November dollarization of legal entities fell to 37.3% (39.3% in October), while dollarization of individuals increased insignificantly to 31.0% (30.9%).

Amid decisions made on the base rate, the weighted average interest rate on fixed-term deposit in KZT of non-banking legal entities increased to 13.8% in November (7.5% in November 2021), on retail deposits – grew up to 13.1% (8.4%).

- Credit market

STB lending to the economy increased by 3.4% m/m and 24.5% y/y and amounted to 22,213.5 billion KZT.

Retail lending rose by 3.8% m/m to 13,891.5 billion KZT, continuing to make the main contribution to the growth of total STB loans. In the structure of retail loans, consumer lending accounts for the bulk with an annual growth accelerated to 27.3% y/y in November (4.4% m/m, in October – 25.2% y/y). High inflationary expectations of the population and the annual marketing campaigns of banks in November contributed to maintenance of significant growth rates in consumer lending. In November, growth rate of mortgage lending slowed down to 42.0% y/y (2.1% m/m).

Corporate loans grew by 11.0% y/y to KZT 8,322.0 billion. In November, monthly growth of the corporate loan portfolio was 2.7% (the highest rate since March 2022).

Volume of loans in the national currency increased by 3.5% m/m to 20,412.2 billion KZT. In their structure, corporate loans went up by 2.8% to 6,528.0 billion KZT, retail loans – by 3.8%, to 13,884.2 billion KZT.

Volume of foreign currency loans expanded by 2.5% m/m to 1,801.3 billion KZT (in foreign currency equivalent, there was an increase of 2.4%). Main contribution to the increase in foreign currency lending was made by corporate loans (a 2.5% growth). Foreign currency loans to individuals decreased by 2.2%, continuing the downward trend since March 2022.

As a result, KZT loans at the end of November 2022 accounted for 91.9% (89.7% in December 2021).

In November, an outpacing growth of long-term loans compared to short-term ones was recorded. Volume of short-term loans went up by 1.8% m/m to 3,698.7 billion KZT, long-term loans – by 3.7% m/m to 18,514.8 billion KZT.

Lending to small businesses accelerated growth paces, with a 4.0% increase in November (an increase of 25.4% y/y, in October – an increase of 1.2% m/m) to 4,452.8 billion KZT.

In November 2022, the weighted average interest rates on loans issued in KZT to non-bank legal entities rose to 18.4% (17.0% in October), and to individuals decreased to 15.3% (17.3%). The decrease in interest rates on retail loans was facilitated by a cut in consumer loan rates due to implementation of marketing campaigns by banks.

In the expanded definition, loans to the economy[5] as of October 1, 2022 amounted to 26.9 trillion KZT, an increase of 13.3% since the beginning of the year. Business loans (non-financial legal entities and individual entrepreneurs who raised loans for business purposes) rose by 5.1% to 13.4 trillion KZT, to the population by 22.8% to 13.5 trillion KZT.

- Payment Systems

As of December 1, 2022, 19 payment systems operate in the Republic of Kazakhstan, including payment systems of the National Bank, money transfer systems, and payment card systems.

In November 2022, 5.7 million transactions amounting to 87.5 trillion KZT were carried out through payment systems of the National Bank (Interbank Money Transfer System and Interbank Clearing System) (as compared to October 2022, up by 7.5% in number, by 32.0% in amount). On average, 259.3 thousand transactions worth 4.0 trillion KZT were made through these payment systems daily.

As of December 1, 2022, 18 banks and Kazpost JSC issue payment cards in the Republic of Kazakhstan. Total number of issued and distributed payment cards amounted to 64.4 million cards. In November 2022, 51.3% of these payment cards (33.0 million payment cards) were used for non-cash transactions and/or cash withdrawals.

In November 2022, 810.2 million transactions were carried out for an amount of 12.0 trillion KZT using payment cards of Kazakhstan's issuers (compared to October 2022, number of transactions declined by 2.5%, amount rose by 3.2%). Share of non-cash payment transactions by number of transactions using payment cards of Kazakhstan’s issuers accounted for 97.5% (790.4 million transactions). Share of volume of non-cash transactions for the same period accounted for 85.0% (10.2 trillion KZT).

In November 2022, total volume of money sent via international money transfer systems was 0.2 million transfers amounting to 98.6 billion KZT. As compared to October 2022, number and volume of money transfers increased by 5.5% and 4.6% respectively. In the total volume of sent transfers, 93.3% of the total number (0.2 million transactions) and 94.9% of the total amount (93.6 billion KZT) of transactions were sent outside Kazakhstan. In Kazakhstan, 6.7% of the total amount (0.02 million transactions) and 5.1% of the total amount (5.0 billion KZT) were made via money transfer systems. Via international money transfer systems from abroad were received 0.1 million transactions in the amount of 60.1 billion KZT.

- Pension System

Pension savings of contributors (recipients) as of December 1, 2022 totaled 14,403.0 billion KZT, an increase of 257.2 billion KZT or up by 1.8% in November2022.

In November 2022, net income from investment of pension assets rose by 131.1 billion KZT up to 7,688.7 billion KZT as of December 1, 2022.

Number of individual pension accounts of contributors for compulsory pension contributions (given individual pension accounts that do not have pension savings) as of December 1, 2022 totaled 10.9 million accounts.

Amount of pension payments in November 2022 was 34.9 billion KZT.

As of December 1, 2022, government securities of the Republic of Kazakhstan and non-government securities of Kazakhstan’s issuers (48.9% and 20.4% of the total volume of pension assets, respectively) account for a bulk of UAPF total investment portfolio.

[1] A weighted average value of yield of one-day repo operations with securities of public stock basket with a 5% cut of transactions with the lowest and highest yield.

[2] TONIA-indexed treasury bonds.

[3] Outstanding KZT public stock (excluding public stock in foreign currency).

[4] Method of the yield function determination of public stock of the Republic of Kazakhstan, posted on an official website of the Kazakhstan Stock Exchange was used to plot the yield curve.

[5] Loans to the economy in the expanded definition represent data about balances of actual debts under loans of the banking sector, mortgage and micro-finance organizations, quasi-state subjects

For more details mass media can contact:

+7 (7172) 775 210

e-mail: press@nationalbank.kz

www.nationalbank.kz