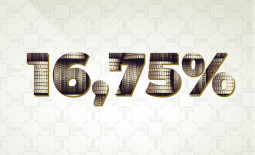

The base rate remains unchanged at 16.75%

The Monetary Policy Committee of the National Bank of the Republic of Kazakhstan has made a decision to maintain the base rate at a level of 16.75% per annum with the interest rate corridor of +/- 1 percentage point. The decision was made based on the updated forecasts of the National Bank, data analysis, and assessment of inflation risk balance.

The pro-inflationary pressure from the external environment is weakening. Inflation worldwide, particularly in trading partner countries, is showing an expected slowdown due to the decrease in global prices of energy and food. The slower growth of external prices amid a stable real exchange rate, creates favorable conditions for inflation deceleration in the country. Pro-inflationary pressures remain in Kazakhstan due to ongoing fiscal stimulus, sustained domestic demand, high and unstable inflation expectations, as well as the increase in prices of fuel and lubricants and the expected rise in tariffs for housing and communal services.

As a result, at the current moment, the aggregate risk balance has only slightly shifted towards disinflationary factors due to the easing pressure from external inflation. Along with the observed slowdown in the indicators of the sustainable part of inflation since September 2022, there may be room for a gradual and slow decline of the base rate in the second half of the current year.

The annual inflation rate in April 2023 continued to decelerate and amounted to 16.8%. Within the inflation structure, the food component is slowing down at a faster pace. However, the deceleration in annual inflation was restrained by the increase in prices of non-food products, which slightly increased due to the rise in fuel and lubricant prices.

The monthly inflation remained at the level of 0.9%, continuing to form above historical averages. However, since September 2022, both the core and seasonally adjusted inflation indicators have been declining, indicating a gradual weakening of the stable part of inflation and pro-inflationary pressure.

Inflation expectations remain volatile and sensitive to short-term shocks. In April, the expected inflation for the next year accounted to 16.7% (in March – 16.5%). Respondents indicate that factors contributing to price increases include higher tariffs for housing and communal services, as well as increased prices for fuel and lubricants and medicines. The planned increase in housing and communal services tariffs, and the actual rise in fuel and lubricant prices have already partially influenced public expectations.

Global inflation continues its expected slowdown but is still assessed as sustainably high. Due to this, regulators have continued to tighten monetary conditions. The deceleration of global food prices and inflation in trading partner countries creates favorable conditions for further slowing of consumer prices in the country. The grain prices growth is slowing down at a faster pace than expected. With the implementation of the grain deal and a high level of supply, further reduction in grain prices is expected, which will contribute to further deceleration of food inflation worldwide.

The oil market is expected to develop moderately amid a slower economic recovery in China, high global inflation, and restraining policies by central banks. Taking into account these factors, the average oil price has been revised downward in the baseline scenario for 2023 and 2024 to $82 and $80 per barrel, respectively.

Taking into account the planned increase in maximum prices housing and communal services tariffs, the actual rise in fuel and lubricant prices, and a higher fiscal impulse - conditions that were not considered in the National Bank's previous forecasts – the inflation forecast has been updated. In the baseline scenario, the annual inflation for the current year is projected to be within the range of 11-14%, 9-11% in 2024, and 5.5-7.5% in 2025. The indirect contribution of the increase in fuel and lubricant prices and housing and communal services tariffs to the consumer price index in 2023-2024 is estimated by the National Bank to be within 1-2.5 percentage points. However, the disinflationary trend will continue, supported by the decrease in global food prices and the easing of monetary and credit conditions, which, as annual inflation declines, begin to have a restraining effect. Continued deceleration of external inflation and inflation expectations is also expected, along with the planned budget consolidation and a return to compliance with budgetary rules in 2024-2025.

The forecast for Kazakhstan's economic growth in 2023 has improved. This year, GDP growth is expected to be in the range of 4.2-5.2%, while the forecasts for 2024-2025 remain at 3.5-4.5%. The upward revision for the current year was influenced by increased government spending and expectations of higher external and domestic demand. However, the positive dynamics of imports due to fiscal stimulus, as well as restraining monetary and credit conditions, will stabilize GDP growth. Risks to the GDP forecast are associated with lower demand for Kazakhstani exports due to the risk of a global recession, pressure in the oil market, and potential access issues for Kazakhstani exports to international markets.

The risks to the inflation forecast include increased fiscal stimulus, stronger secondary round effects from the increase in fuel and lubricant prices and housing and communal services tariffs, the prolonged impact of the restructuring of logistics and production chains on pricing, and the likelihood of anchoring inflation expectations at high levels.

With further decline in annual inflation according to the forecast, moderate indirect effects from the increase in fuel and lubricant prices and housing and communal services tariffs, accompanied by a sustained decrease in core inflation, and compliance with the budget rule in the formation of the budget for 2024-2025, the National Bank will assess the feasibility of a cautious and gradual reduction of the base rate in the second half of 2023.

The key parameters of the forecast are provided in the appendix to the press release. More detailed information about the factors behind the decision and the forecast will be presented in the Monetary Policy Report on the official website of the National Bank[1] on June 5, 2023.

The next scheduled decision of the Monetary Policy Committee of the National Bank of Kazakhstan on the base rate will be announced on July 5, 2023, at 12:00 Astana time.

[1] https://www.nationalbank.kz/en/page/obzor-inflyacii-dkp

More detailed information for the mass media representatives is available upon request:

+7 (7172) 775 210

e-mail: press@nationalbank.kz

www.nationalbank.kz

Appendix

Key forecast parameters of the National Bank of the Republic of Kazakhstan according to the baseline scenario

|

|

2023 |

2024 |

2025 |

|

|

Forecast conditions |

||||

|

The price of Brent crude oil, |

82 (88) |

80 (85) |

77 (77) |

|

|

Forecast |

||||

|

GDP |

4,2-5,2 (3,5-4,5) |

3,5-4,5 (3,5-4,5) |

3,5-4,5 (3,5-4,5) |

|

|

CPI |

11-14 (9-12) |

9-11 (6-8) |

5,5-7,5 (4-6) |

|

|

Сurrent account, in % of GDP |

-2,4 |

-2,1 |

-1,3 |

|