Situation on Financial Market in October 2022

- Operations of the National Bank in Monetary Policy

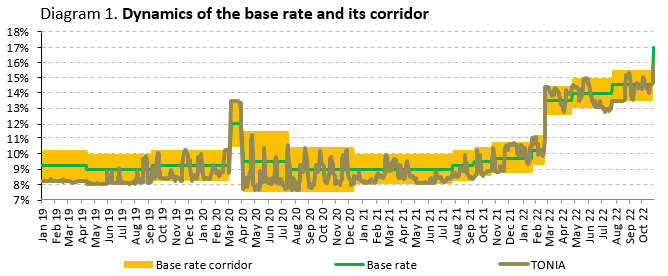

On October 26, the base rate was increased from 14.5% to 16% against the background of a significant acceleration of inflation, as well as formation of current inflationary processes above forecast estimates of the National Bank

TONIA[1] indicator was formed within the interest rate corridor in October 2022 (diagram 1). In October, the weighted average value of TONIA followed the base rate and rose by 0.2 percentage point to make 14.6% p.a. (14.4% in September 2022). During October, TONIA rate formed near the upper limit.

Monetary policy Instruments. At the end of October 2022, negative balance of operations of the National Bank (open position of the National Bank) on the money market totaled 3.0 trillion KZT.

Volume of short-term notes in circulation in the end of October 2022 made 1,149.6 billion KZT with a 33.2% plunge for the month. In October, a minimum volume of notes in circulation was recorded for the first time since May 2016. Three auctions of NBK notes were held for a total of 1,737.2 billion KZT, the entire placement volume included 1-month notes (weighted average yield of 14.99%). Redemption volume of short-term notes of the National Bank in October amounted to 1,741.3 billion KZT.

Against the background of the reduction of notes, free liquidity of participants flows into other, shorter-term money market instruments. Volume of liquidity withdrawn through deposit auctions rose 23.8% in October and amounted to 1,068.0 billion KZT (863.0 billion KZT in September), bank deposits with the National Bank – by 24.8% and totaled 763. 2 billion KZT (611.6 billion KZT). Volume of operations to withdraw liquidity through direct repo transactions made 63.6 billion KZT.

As of the end of October, short-term notes account for almost 38% of the withdrawn liquidity, deposit auctions for 35%, NBK deposits for 25%.

- Government securities of the Ministry of Finance of the Republic of Kazakhstan

In October 2022, the Ministry of Finance of the Republic of Kazakhstan carried out 12 placements of short-term government securities (MEOKAM – 5 placements, METIKAM[2] – 7 placements) with maturities ranging from 2 to 5 years in the amount of 322.4 billion KZT. The yield on them made 13.90-15.45% p.a.

Volume of securities of the Ministry of Finance of the Republic of Kazakhstan in circulation grew by 2.4% m/m in October, and by 17.03%[3] since the beginning of the year.

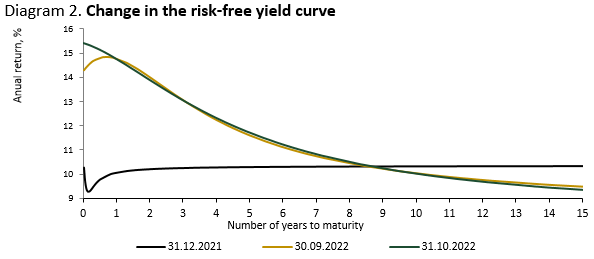

In October, the risk-free yield curve shows[4] an inverted (reverse) form against the background of the October increase in the base rate from 14.5% to 16.0%. In particular, growth of the yield curve is reported in the short-term segment up to 1 year and slightly in the segment from 3 years to 10 years, and in the segment from 10 to 15 years there is a downward shift relative to September.

Source: KASE

- Foreign exchange market

Against the background of balance of supply and demand for USD in October 2022, KZT exchange rate fluctuated within the range of 465.02–479.05 KZT per US Dollar.

In October 2022, supply on the foreign exchange market was supported by sales of export earnings from the quasi-public sector (USD 528.6 million) and foreign currency conversions for transfers from the National Fund (USD 362 million). Due to the balance of supply and demand on the foreign exchange market, foreign exchange interventions were not carried out.

Total volume of transactions on the KZT-USD currency pair contracted by 5.7% over the month (decrease – by 13.2% y/y), including volume of exchange trading on the Kazakhstan Stock Exchange rose by 20.6% m/m and decreased by 10.3% y/y.

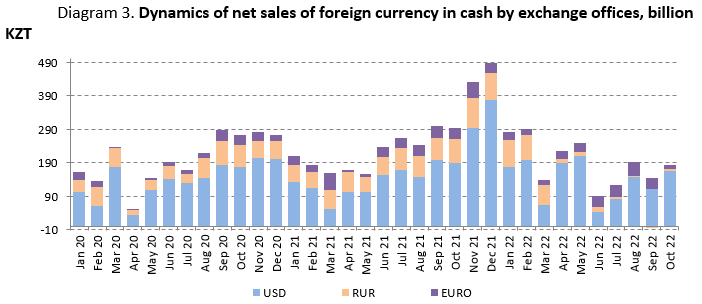

Demand from the population for foreign currency increased. In October 2022, net purchase of foreign currency surged by 29.8% m/m. Along with that, in annual terms, total volume of net purchases plummeted by 36.9%, mainly due to a decrease in net purchases of the Russian rubles and Euros.

The bulk volume of expenses was directed to buy the USD – 88.6%, or 164.7 billion KZT, the Russian ruble – 3.7%, or 6.9 billion KZT, and the Euros – 7.3%, or 13.6 billion KZT. In contrast to the historic September excess of the supply of rubles over demand, in conditions of abating turmoil with partial mobilization in Russia, in October there was again a positive net purchase of rubles. Despite the fact that the demand for the Russian rubles exceeded the supply in October, ruble purchase on a net basis plunged by 10.4 times y/y.

In a breakdown by type of currency, net USD purchases soared by 44.9% over the month (a decrease of 12.6% y/y), purchases of Euros shrank by 2.4 times (a decrease of 2.5 times y/y).

- International reserves and monetary aggregates

Gross international reserves of the National Bank for October 2022, according to preliminary data, inched up by 1.0% to make USD 33.0 billion.

Reserves in the FX part grew due to the inflow of client funds and STB funds to foreign currency correspondent accounts with the National Bank. Partially, the increase in reserves was offset by payment of external public debt and falling gold prices.

International reserves of the country as a whole, including assets of the National Fund in foreign currency (USD 52.4 billion), at the end of October 2022 stood at USD 85.4 billion.

Monetary base in October 2022 expanded by 4.2%, to 12,374.4 billion KZT (since the beginning of the year – an expansion of 12.9%), against the background of a growing volume of bank deposits.

In October 2022, money supply increased by 2.6% and amounted to 33,311.6 billion KZT (from the beginning of the year – by 10.7% and 14.8% y/y), cash in circulation decreased by 0.2% (since the beginning of the year – an increase of 10.4%). Retail lending, first of all consumer and mortgage lending, continues to be a key factor that triggers growth of the money supply.

- Deposit Market

Volume of residents' deposits with depository institutions in October 2022 increased by 2.9% m/m (growth of 15.3% y/y). Corporate deposits for the month expanded by 4.1%, retail deposits by 1.5%. The increase in volume of the deposit portfolio is mainly attributed by growing KZT deposits (75.4% contribution to growth of the total deposit portfolio).

Volume of deposits in the national currency in October increased by 3.4% m/m to 19.4 trillion tenge, mainly due to an increase in corporate deposits by 4.1% (contribution of 2.0% percentage points to the change in KZT deposits). In foreign currency, growth of deposits amounted to 2.0% and was formed due to increase in funds of legal entities. On the contrary, individuals showed a decrease in foreign currency deposits and an increase in national currency deposits in conditions of continued attractiveness of KZT deposits due to a current level of the base rate and corresponding marginal KDIF rates. As a result, dollarization level of deposits in October was 35.3% (35.6% in September, 36.0% in December 2021).

In the dollarization structure, gap between dollarization of legal entities and individuals has widened. Thus, in October dollarization of legal entities remained at the level of 39.3%, while dollarization of individuals continued to decline making 30.9% (31.7% in September).

A significant decrease in dollarization (including non-residents) in terms of amounts is reported in the segment of small and medium-sized depositors. Excluding deposits with Otbasy Bank JSC and large deposits (over 50 million KZT), share of retail deposits in foreign currency decreased by 10.6 percentage points, down to 13.7% since the beginning of the year.

Amid taken decisions regarding the base rate, the weighted average interest rate on fixed-term deposits in KZT of non-banking legal entities increased to 13.6% (7.5% in October 2021), on retail deposits – increased to 12.6 % (8.4%).

- Credit market

Lending by second-tier banks (hereinafter – STB) to the economy increased by 1.8% m/m and 24.9% y/y and totaled 21,481.0 billion KZT, mainly due to growing retail loans.

Retail lending rose by 2.4% m/m, continuing to make the main contribution to the growth of total STB loans. In the structure of retail loans, consumer lending accounts for the main share and it slowed down the growth rate to 25.2% y/y (1.5% m/m) and made 7,302.1 billion KZT. However, high inflationary expectations of the population contribute to maintaining a significant growth rate in consumer lending. In October, high growth rates of mortgage lending continued amid a significant increase in rental fee of accommodation and active disbursement of funds within the 7-20-25 program (by 47.1% y/y, by 3.9% m/m, volume – 4,443.3 billion KZT).

In annual terms, corporate lending accelerated to 11.4% in October from 9.1% in September, while compared to the peak in February (15.6%), annual growth rates slowed down. Key reasons behind the slowdown in growth are the high base in 2021, decline in lending activities of the Russian subsidiary banks and an increase in a minimum threshold for withdrawing funds from the UAPF. Also, improvement of the KZT exchange rate from peaks in February-March entailed a statistical decrease in the corporate loan portfolio due to currency revaluation. Monthly growth of corporate loan portfolio slowed down to 0.8%.

Volume of loans in the national currency increased by 2.0% m/m to 19,723.7 billion KZT. In their structure, corporate loans rose by 1.1%, to 6,352.1 billion KZT, retail loans – by 2.4% to 13,371.6 billion KZT.

Volume of loans in foreign currency shrank by 0.7% m/m to KZT1,757.3 billion, including due to their currency revaluation (an increase of 1.1% in foreign currency equivalent).

Main contribution to the contraction of foreign currency lending was made by corporate loans, which decreased by 0.5%. FX retail loans decreased by 24.2%, continuing the downward trend since February 2022.

As a result, share of KZT loans in late October 2022 accounted for 91.8% (89.7% in December 2021).

In October, short-term loans outpaced long-term loans. Volume of short-term loans went up by 3.0% m/m, long-term loans by 1.6% m/m.

Lending to small businesses slowed down its growth pace, with a 1.2% increase in October (up by 31.4% y/y, in September – an increase of 4.7% m/m) to 4,280.7 billion KZT.

In October 2022, the weighted average interest rates on KZT loans issued to non-bank legal entities rose to 17.0% (16.2% in September 2022), to individuals decreased to 17.3% (17.8%).

- Payment systems

As of November 1, 2022, 19 payment systems operate in the Republic of Kazakhstan, including payment systems of the National Bank, money transfer systems, and payment card systems.

In October 2022, 5.3 million transactions worth 66.3 trillion KZT were carried out through the payment systems of the National Bank (Interbank Money Transfer System and Interbank Clearing System) (with a 2.0% m/m decrease in terms of quantity and a 0.3% m/m decline in amount). On average, 265.4 thousand transactions in the amount of 3.3 trillion KZT were carried out through these payment systems daily.

As of November 1, 2022, 18 banks and Kazpost JSC issued payment cards in the Republic of Kazakhstan. Total number of issued and distributed payment cards was 63.6 million cards. Thus, in October 2022, 50.7% of payment cards (32.2 million payment cards) were used for non-cash transactions and/or cash withdrawal transactions.

In October 2022, 831.4 million transactions were carried out using payment cards of Kazakhstan’s issuers in the amount of 11.6 trillion KZT (number of transactions rose by 2.5% m/m, their amount by 5.3%). Share of non-cash payment transactions in terms of number of transactions using payment cards of Kazakhstan’s issuers amounted to 97.5% (810.3 million transactions). Volume of non-cash transactions for the same period accounted for 84.6% (KZT 9.8 trillion).

In October 2022, total amount of money remitted via international money transfer systems made 200 thousand transfers for a total of 94.2 billion KZT. Number and volume of money transfers decreased m/m by 7.9% and 6.3%, respectively. In the total volume of sent transfers, 94.9% of the total number (200 thousand transactions) and 94.8% of the total amount (89.3 billion KZT) of transactions were sent outside Kazakhstan. In Kazakhstan, 5.1% of the total amount (10 thousand transactions) and 5.2% of the total amount (4.9 billion KZT) were carried out through money transfer systems. 200 thousand transactions in the amount of 74.3 billion KZT were received from abroad, through international money transfer systems.

- Pension System

Pension savings of contributors (recipients) as of November 1, 2022 totaled 14,145.8 billion KZT, an increase of 41.7 billion KZT or up by 0.3% in October 2022.

In October 2022, net income from investment of pension assets rose by 70.8 billion KZT up to 7,557.6 billion KZT as of November 1, 2022.

Number of individual pension accounts of contributors for compulsory pension contributions (given individual pension accounts that do not have pension savings) as of November 1, 2022 totaled 10.9 million accounts.

Amount of pension payments in October 2022 was 31.5 billion KZT.

As of November 1, 2022, government securities of the Republic of Kazakhstan and non-government securities of Kazakhstan’s issuers (47.6% and 20.6% of the total volume of pension assets, respectively) account for a bulk of UAPF total investment portfolio.

- Monitoring of Enterprises for Quarter III

According to results of monitoring of enterprises, a slowdown in the economic activity in the real sector is reported. Along with that, there is a slight increase in demand for finished products, capacity utilization and production volumes of finished products.

Utilization of production capacities of enterprises increased, weighted average utilization level made 54.4% (53.7% in Q2 2022).

Volume of production of finished goods rose. Diffusion index (hereinafter referred to as ‘DI’) rose from 53.7 to 54.7.

Demand for finished products of enterprises slightly improved. DI changed from 51.5 to 51.7. In Q4 2022, enterprises expect that demand for finished products will slightly slack.

Growth rate of prices for finished products of enterprises in the economy as a whole decelerated, DI was 63.1. In Q4 2022, enterprises expect a slowdown in growth rates of prices for raw materials and, accordingly, for finished products.

In Q3 2022, 16.2% of the surveyed enterprises sought a bank loan, 15.4% of enterprises received a loan (or 95.1% of those who requested a loan). The vast majority of enterprises (82.8%) raised funds to finance working capital (purchase of materials, raw materials, semi-finished products, etc.).

The state of Kazakhstan’s economy is still the main obstacle to doing business for 35.6% of enterprises. Other obstacles include market competition (28.7%), level of tax burden and search for buyers (23.4% each), lack of qualified personnel (22.3%), difficulty of recovering receivables (13.4%), while access to financing ranks the 8th (12.7%) in terms of significance.

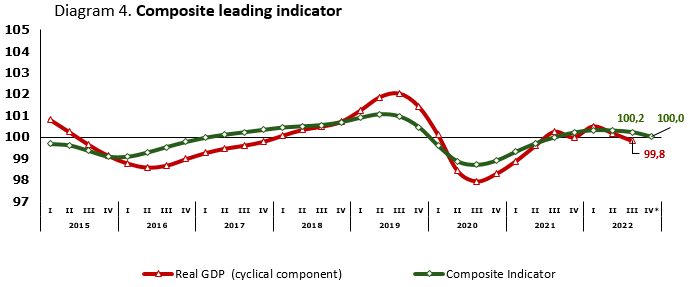

The Composite Leading Indicator (CLI), which is an aggregated assessment of business surveys, demonstrates a slowdown in the growth of economic activity in the real sector. CLI was 100.2.

In the fourth quarter of 2022, a further slowdown in the growth rate of economic activity is expected (CLI, according to expectations, made 100.0).

[1] A weighted average value of yield of one-day repo operations with securities of public stock basket with a 5% cut of transactions with the lowest and highest yield.

[2] Treasury bonds indexed to TONIA rate.

[3] Outstanding KZT public stock (excluding public stock in foreign currency).

[4] Method of the yield function determination of public stock of the Republic of Kazakhstan, posted on an official website of the Kazakhstan Stock Exchange was used to plot the yield curve.

For more details mass media can contact:

+7 (7172) 775 210

e-mail: press@nationalbank.kz

www.nationalbank.kz